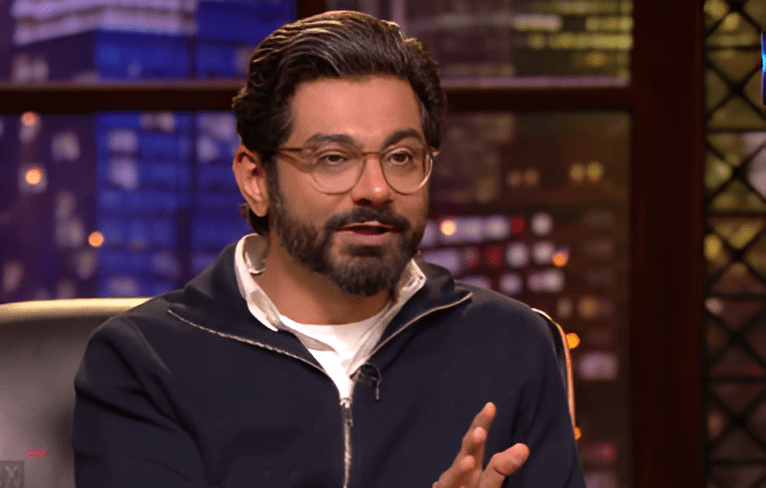

Varun Dua and Ruchi Deepak started ACKO General Insurance Company in 2016, Acko provides five types of insurance: car, bike, health, life, and travel insurance. The most important part of their mission is that all of this happens online, eliminating the hassle of paperwork. This makes Acko India’s first digital insurer. Varun Dua get fame from being a judge on shark tank india season 3.

Varun Dua was born in Delhi on 25th February 1981, his father’s name was Chander Mohan Dua he was also in the Insurance sector for more than 10 years. Varun Dua Education details, He pursued his Bachelor’s from Mumbai University and Master’s Degree from MICA, Ahmedabad.

After completing his graduation Varun worked as a trainee in Burnett Advertising for a year, He was also working as marketing manager for TATA AIG Life Insurance and Franklin Templeton.Varun Dua started ACKO general insurance company as he knew about the Insurance sector, products, offers, etc.

Varun Dua Experience

- CEO

Acko

Nov 2016 to Present · 7 yrs 9 months

Bengaluru, Karnataka, India - CEO

Coverfox Insurance

Oct 2013 to Nov 2016 · 3 yrs 2 months

Mumbai Area, India - Co-Founder

GlitterBug Technologies

Nov 2010 to May 2013 · 2 yrs 7 months

Mumbai

Online Insurance Vertical Specialist

Built Web Apps – assisting online Insurance sales.

Brands such as ICICI Prudential, HDFC Life, and Aviva – use Glitterbug Tech’s product to enable and improve their online portfolio.

Integrating Online Business with Core Company Applications, Cloud-based voice record storage, management, and retrieval. Front-end conversion optimization and mobility solutions

- Marketing Manager

Franklin Templeton Investments

Jan 2007 to Feb 2008 · 1 yr 2 months

Mumbai Area, India - Marketing Manager

Tata AIG Life Insurance

2003 – 2007 · 4 yrs - Trainee

Leo Burnett Advertising

2002 – 2002 · Less than a year

Varun Dua’s Net Worth And Investments

Varun Dua has raised $ 107 Cr for his Acko Insurance Company. Acko Insurance Company’s net worth is estimated at around 1750 Cr. Their most recent investment was in Tohands (Angel Round) on Mar 01, 2024.

Total Companies Invested In Shark Tank India Season 3

2 (Plus and Tohands)

Business Model

Acko’s business model is D2C (direct to consumer). Here’s how it works:

- Revenue from Premiums: Acko earns money by selling insurance policies.

- Commissions: Acko has partnerships with some companies and earns money by selling insurance to the customers of those partner companies.

- Data Monetization: Acko generates revenue by collecting valuable consumer data and using it for marketing, advertising, and analytical services.

Financials

- FY 2022:

- Revenue: ₹1344 crores

- Expenses: ₹1835 crores

- Loss: ₹483 crores

- EBITDA margin: 34.5%

- FY 2023:

- Revenue: ₹1759 crores

- Expenses: ₹2525 crores

- Loss: ₹738 crores

- EBITDA margin: 40.5%

- Challenges

- Regulatory Environment: The insurance industry is heavily regulated, requiring a license from IRDAI (Insurance Regulatory and Development Authority of India).

- Technology Infrastructure: As India’s first digital insurer, Acko had to strengthen its technology infrastructure to succeed.

Varun Dua In Shark Tank Interview

Acko General Insurance Office Address and Website Link

Hustlehub Tech Park Building, #36/5, Hustlehub One East, Somasandrapalya, 27th Main Rd, Sector 2, ITI Layout, 1st Sector, HSR Layout, Bengaluru, Karnataka 560102.

Frequently Asked Question

Which company backs ACKO?

ACKO is backed by leading venture capitalists including Accel, Elevation, Lightspeed Multiples, General Atlantic, and Multiples Private Equity.

How old is ACKO?

ACKO started in 2016 as India’s first digital insurance company in India.

Is ACKO owned by Amazon?

ACKO General Insurance Co. Ltd backed by Amazon, has raised 22.5 Cr, At a valuation of 7500 Cr.

Is ACKO a unicorn?

In October 2021, the company secured its position as India’s 34th unicorn

Is ACKO making profit?

As per the management, 60% of the auto portfolio is already profitable and will become a fully profitable auto segment in the next financial year.

Is ACKO listed in stock market?

Acko’s share price is Rs 900 Per equity share with a face value of Rs10.